IMA® Hosts Global Economic Confidence Roundtables in the Middle East

Discussions focused on Middle East economic confidence index, which recovered in Q4 2019 according to latest economic research from IMA and ACCA

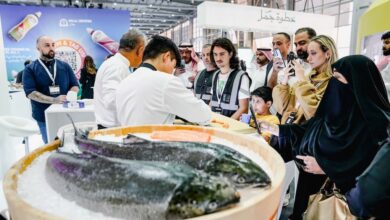

Newsgate360 – Dubai: Experts from IMA® (Institute of Management Accountants) and ACCA (the Association of Chartered Certified Accountants) hosted a series of roundtables in the UAE and Saudi Arabia which revolved around the findings from the latest Global Economic Conditions Survey (GECS) from IMA® and ACCA.

These strategic sessions were led by Raef Lawson, Ph.D., CMA, CPA, IMA vice president of research and policy, one of the main authors of the GECS report, who discussed the insights gathered from the last quarter of 2019 with a number of CFOs, IMA members and ACCA members from around the region.

The global poll of 2,560 accountants found that economic confidence in the Middle East had recovered on the back of rising oil prices and a lessening of geopolitical risk in the region in Q4 2019. This “remarkable turnaround for the region is also thanks to tremendous initiatives to diversify from oil,” as noted by one of the attendees, affirms a rebound from a slight dip in Q2 of 2019 and continues to remain well above the record lows noted through the second half of 2018.

The results of the report suggest a positive outlook for the Middle East as a function of rising oil prices, which were expected to reach $60 to $70 per barrel range this year. “A reduction in interest rates by the Federal Reserve, coupled with fixed exchange rates with the US dollar, will also have an impact on regional economies by enabling private sector credit growth and stimulating the non-oil private sector,” said Lawson.

The UAE experienced growth of over 1.5% in 2018, and according to the GECS index, the outlook for GDP growth in the UAE for 2020 is around 2%. Even as oil production in the country is expected to decline, mega projects such as Dubai’s Expo 2020 are expected to boost economic growth through non-oil private sector activities.

The research indicates that GDP growth in Saudi Arabia was less than 0.5% in 2018 due to falling oil production and lower average oil prices. However, growth is expected to be revived as the country continues to push for diversification whilst reducing its reliance on the oil sector, both of which are fundamental components of the Saudi Vision 2030. Reforms in the entertainment and tourism sectors specifically are also expected to be key drivers of economic growth.

“With mega projects approaching their implementation phases in the UAE and Saudi, the real estate sector, an increasingly important element to regional economies, will especially benefit from lower borrowing costs. This is further complemented by a significant drop in problems accessing finance; marked at a three-year low in Q4 2019 as per the regional GECS index. It is also supported by the significant improvement in global orders balance and confidence compared with Q3 2019, suggesting a brighter outlook for the region,” added Lawson.

GECS indicates that the Middle East had a positive change in confidence over the quarter, and this rise in confidence was higher than the global average, with expected regional growth of 1.5% to 2% this year. The outlook for oil producing economies in the region is likely to make a recovery due to more stable oil prices. The UAE and Saudi Arabia in particular are making considerable efforts to diversify away from the oil sector by strengthening their non-oil private sectors. They are also holding world scale events such as Dubai’s Expo 2020 that will continue to stimulate economic growth.

Fazeela Gopalani, Head of Middle East ACCA, said: “Diversification is crucial to the economy’s recovery. The non-oil sector is playing a key role in boosting growth within the Middle East. Saudi Arabia and the UAE are investing heavily in sectors including tourism, entertainment and infrastructure that will enhance the local and regional economy. The Q4 GECS recorded a significant improvement in business confidence compared with Q3, suggesting a brighter outlook.”

“Even after Brexit, we expect the bilateral trade between the UK and the Middle East to continue to remain positive for both markets.” Lawson concluded.

The events also discussed the impact of the Coronavirus, which has affected the global economy by potentially losing $160 billion this year. It is estimated that the global hit from this new outbreak could be three to four times larger than the $40 billion blow from SARS.

Hello! Someone during my Myspace group shared this site along

with us therefore i arrived at provide it with

a peek. I’m definitely enjoying the details. I’m bookmarking and will be

tweeting this to my followers! Excellent blog and amazing design and magnificence.

Touche. Sound arguments. Keep up the good effort.

Feel free to surf to my web site; ElviaWWilton

I every time used to study article in news papers

the good news is as I am a user of internet therefore from

now I am using net for articles or reviews, due to web.

This post is worth everyone’s attention. Where can I find out more?

Thank you.. follow us and we will keep posting updates

Generally I will not read post on blogs, but I would

like to say that this write-up very forced me to have a

look at and do it! Your writing taste is

surprised me. Many thanks, quite nice post.