Excess liquidity can encourage risk-taking but cause asset price overvaluation, OECD official tells TRENDS E-Symposium

Prominent experts outline the risks and opportunities associated with financial stimulus programs adopted worldwide in the wake of the Covid-19 pandemic

ABU DHABI – ![]() :Unconventional financial tools such as frequent liquidity injections may restore credit flows and facilitate recovery but run the risk of asset price overvaluation, Dr. Patrick Lenain, Assistant Director at the OECD, France, said on Tuesday.

:Unconventional financial tools such as frequent liquidity injections may restore credit flows and facilitate recovery but run the risk of asset price overvaluation, Dr. Patrick Lenain, Assistant Director at the OECD, France, said on Tuesday.

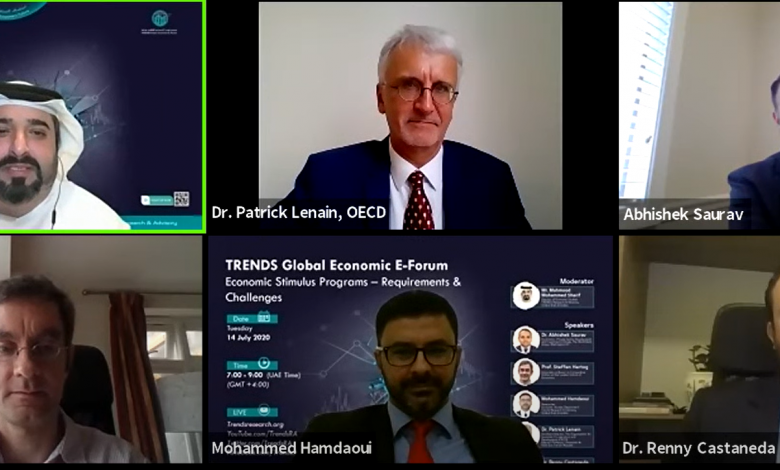

Addressing an E-Symposium – Economic Stimulus Programs – Requirements and Challenges, organized by TRENDS Research & Advisory – Dr. Lenain said the policy is encouraging borrowing, which often causes the risk of over-indebtedness.

“These tools may have positive effects such as restoring credit flows, facilitating recovery, and encouraging risk-taking. They lower the risk of non-performing loans and sovereign default. However, they also risk harming bank profitability and income equality,” he said.

Dr. Lenain said that massive monetary injections also require central bank independence and credibility, which is not always the case in emerging markets. “The big concern with liquidity injection is that it would lead to a depreciation of the currency, higher inflation, financial stability risks, and foreign exchange mismatches,” said Dr. Lenain.

According to Dr. Lenain, emerging market central banks often do not have the legal framework, as buying bonds are forbidden. He also cited the example of massive currency depreciation in countries like Brazil, South Africa, Argentina, Turkey, Mexico, and Russia following the Covid-19 outbreak.

Speaking at the E-Symposium, Prof. Steffen Hertog, Associate Professor in Comparative Politics at the London School of Economics (LSE), said that the GCC has unique and particular vulnerabilities given the volatility of the oil prices.

“Growth depends on state spending, which will have to reach the pre-crisis level to bridge the gap and move forward for the GCC region,” he said, adding, “The GCC economic system suggests that the recovery might not be as fast as other developed economies.”

“Many people in the GCC are employed by the state, directly or indirectly, which means that many variables in the recovery phase will depend on government policies and government spending,” said Hertog.

According to him, we might see an L-shared, rather than a V-shaped recovery, unless the oil prices recover. “Going forward, policy-wise, the transition to building a non-oil revenue is becoming urgent, but short-term measures to get there might be quite challenging and painful to the consumers,” he added.

Prof. Hertog emphasized that the most urgent policy going forward is to make fiscal spending more efficient. “The social contract might be revised in the coming times – the role of government employment needs to be re-assessed, given the chronic over-employment and almost guaranteed employment for some,” he said.

According to him, the real policy challenge will be to encourage nationals to participate in the private sector to a greater extent to maintain the reasonably broad middle-class sector that has already been present and well established in the region.

“Similar policies of government subsidies and income supplement from the government for nationals in the private sector have already been implemented in Singapore, thus prompting us to say that its implementation might benefit the GCC post-crisis development,” Prof. Hertog said.

He added that basic welfare to everyone without a guarantee of a government job in the public sector is another option. “The Covid-19 crisis has increased the need for fundamental fiscal and distribution reform and shifting the national populations of the region toward the private sector and more entrepreneurship,” he said.

During the symposium, Dr. Abishek Saurav, an Economist at the World Bank Group, highlighted structural policies and the development of infrastructure to tackle the pandemic. “On the supply side, the effect has been felt across the developed and developing countries. On the demand side, there is a marked shift in consumer behavior. People are looking for substitutes for things included in normal consumption prior to the crisis,” he said.

Dr. Saurav said that the world is witnessing a systemic shock, and the economic vulnerabilities have been magnified. “Women, youth, and some other groups face almost a certain loss of income and livelihood,” he said. He specifically mentioned workers in the informal sector, which comprises up to 70 percent of businesses in some countries.

“Their vulnerabilities are not visible, translating into a massive array of problems for people who participate in such sectors,” he said, quoting figures from the International Labor Organization. “The informal sector’s vulnerability needs to be tackled in the short-run, and tackling SMEs’ access to easier financial backup,” Dr. Abishek Saurav said.

The E-Symposium was part of TRENDS Research & Advisory’s Global Economic Forum series, which routinely gathers experts and researchers from around the world.