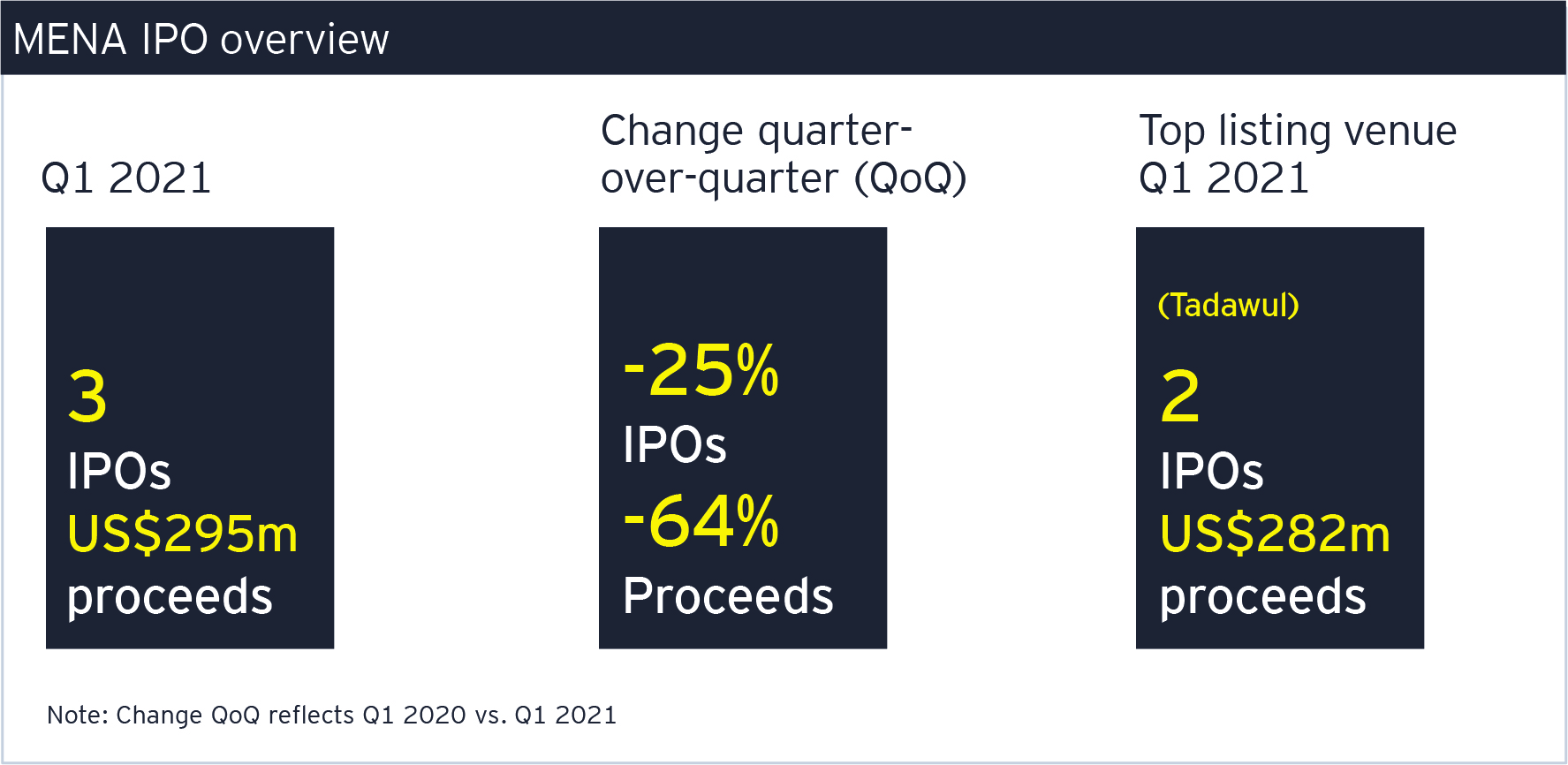

EY: Three MENA IPOs raised US$294.8 million in Q1 2021

MENA region saw a total of three IPOs in Q1, raising proceeds of US$294.8 million

Riyadh –

According to the EY MENA IPO Eye Q1 2021 report, the MENA region saw three IPOs raise total proceeds of US$294.8 million during the first quarter of 2021, a 64% drop in proceeds raised when compared with the same period in 2020. The three issuances were in the transport, power and utilities and real estate sectors.

Despite expectations for an increase in activity after an uptick in issuances in Q4 2020 – which saw four IPOs and US$925 million in proceeds – the IPO market in the MENA region had a slow start to 2021. Continued uncertainty around the impact of the ongoing pandemic has affected the MENA markets even as oil prices have continued their recovery and vaccination roll outs have been gaining speed across the region.

Globally, Q1 2021 has been the best-performing first quarter by deal number and proceeds in the last 20 years, despite the trend of Q1 being a slower period. The first quarter of 2021 saw 430 IPOs – compared to 233 in Q1 2020 – as well as US$105.6 billion in proceeds, up 271% when compared to the same quarter last year. The surge in momentum can be attributed to the ample liquidity in the financial systems; the accelerated growth of technology and new economy companies propelled by the pandemic; speculative and opportunistic transactions; and platforms that have made retail investing more accessible to the general public and young generations.

Matthew Benson, EY MENA Strategy and Transactions Leader, says:

“The MENA region’s IPO market was off to a slower than expected start in 2021, despite expectations for an increase in IPO activity after an uptick and stronger performance in Q4 of 2020, with total proceeds down by 64% in Q1 2021 when compared to the same period last year. The three IPOs during this quarter, which raised a total of US$295m in proceeds, demonstrated strong investor demand in the market, particularly in KSA — hence we expect IPO activity to bounce back over the coming months while economic conditions in the region continue to improve, aided by the accelerated vaccine rollouts and the possibility of reaching herd immunity against COVID-19.”

Saudi Arabia continues to have the most active IPO market in MENA

The Saudi Stock Exchange (Tadawul) continued to be the MENA region’s top listing venue in Q1, with two listings totaling $US281.6 million, which represented 96% of the total amount raised by MENA IPO candidates during the quarter. The previous year, it had four listings totaling $1.45 billion, representing 78% of the total amount raised by MENA IPO candidates in 2020.

The first listing on the Tadawul for 2021, Alkhorayef Water & Power Technologies, raised US$144 million by floating 30% of its shares. The offering was heavily oversubscribed, with the retail offering being oversubscribed by 1,511% and the institutional offering by 6,320%.

That IPO was followed by that of Theeb Rent a Car Company, which offered 30% of its shares to the public and raised US$138 million. As with Alkhorayef Water & Power Technologies, the Theeb IPO was heavily oversubscribed, with strong demand leading an oversubscription of 6,010% for the institutional tranche and 3,385% for the retail offering.

Tadawul’s own IPO also continued to gain traction, as the exchange announced its conversion into a holding company with four subsidiaries as preparation for its IPO. It is now said to be in the process of selecting advisors for the transaction, with the IPO expected later this year.

Furthermore, Tadawul and the Securities Depository Centre Company (EDAA) announced enhancements to the regulations of securities borrowing and lending (SBL) and short selling, following the Capital Market Authority’s (CMA) approval. The enhancements to the short selling framework include a provision that total net short positions must not exceed 10% of the free floated securities of the relevant security. Additionally, Tadawul will publish a daily report for total net short positions after the trading session on its website.

Gregory Hughes, EY MENA IPO and Transaction Diligence Leader, says:

“As we look at the remainder of 2021 and beyond, there are many reasons to be optimistic about the upcoming quarters ahead. A strong IPO pipeline in key MENA markets across sectors, coupled with various government initiatives to deepen the capital markets, particularly in KSA and the UAE, should help bring more IPOs to markets in the region. Additionally, the underlying economic factors within the region remain strong and we anticipate that future IPO activity in the MENA region will reflect the overall positive signs that we are beginning to see.”